Take our 3 minute quiz and match with an advisor today. This content is powered by HomeInsurance.com, a licensed insurance producer (NPN: 8781838) and a corporate affiliate of Bankrate.com. First, consider carefully who you want to benefit from your policy. Changing life insurance beneficiary after death can be a complex process depending on the type of policy involved and the state where the policy was issued.

The beneficiary will receive the death benefit when you die as long as the policy is still active. When a person purchases life insurance, they designate one or more beneficiaries to receive the insurance payment.

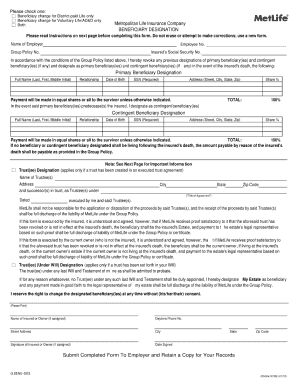

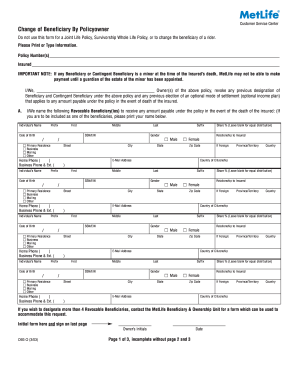

Many cases go instead to arbitration or mediation, in which the two parties negotiate an agreement instead of fighting it out in court and watching the life insurance payout dwindle away as legal fees accumulate. Our goal is to give you the best advice to help you make smart personal finance decisions. If one of them is deceased, then the other one will get the entire death benefit. An irrevocable beneficiary is a named recipient of a life insurance policys proceeds who controls whether any changes can be made to the beneficiary of the policy. You can find Christians most recent articles in ourblog. haumea in virgo; flutter uint8list to bytes; swamp loggers episodes. What Does E & O Insurance Cover For Buyers And Sellers? Some insurers may also require the change form to be notarized in order for it to be binding.

But if youre unable to show evidence that supports your claim, the court may rule in favor of your sibling and allow them to remain as the sole beneficiary. The benefits that come with your life insurance are intended to help financially support your loved ones after you pass away. You can typically change, add or remove revocable life insurance beneficiaries at any time. These cookies do not store any personal information. They can also take time to process so it may be months or even years before a death benefit can be paid out, depending on the nature of the dispute claim. To ensure that your beneficiary designations meet your specific needs and address They both own life insurance policies on the other spouses life and are the beneficiaries of those policies. Under most circumstances, a spouse doesnt have any right to submit a claim and be paid life insurance proceeds if someone else is named the beneficiary, unless they live in a community property state. When taking out a life insurance policy, you name two beneficiaries: the primary beneficiary and the contingent beneficiary. If youre married or have children, its important that you know what these rules are. They are: Alaska and Tennessee are opt-in states, meaning that spouses can opt in and participate in their states community property laws. So, if the decedents Will says everything to my three children, but if any of my children predecease me, then I leave that deceased childs share to my other surviving children, equally, your siblings would inherit your share. To illustrate this rule, lets use a situation involving Peter and Ruth. This is not an offer to buy or sell any security or interest. And if you dont have a financial advisor, finding one doesnt have to be complicated. Contesting life insurance beneficiary designations can happen for a number of reasons. Instagram. As mentioned in the How to Change the Beneficiary on Your Life Insurance section, all you have to do is contact the life insurance company and request a change of beneficiary form.

To challenge the policy change, the daughter needs legal advice. If youre one of four beneficiaries, that doesnt automatically mean youll get one quarter of the death benefits. 5. All of our content is authored by Like any insurance policy, life insurance has its stipulations and restrictions. Beneficiary Benefits At the time you retired, you selected a plan of payment, also called a retirement option. If you have student loans, car loans, installment loans, or any other type of debt, your life insurance policy can be used to pay off those debts, so your survivors arent saddled with them.

John owns a life insurance policy and has named his wife Mary as the beneficiary. If there are no contingent beneficiaries, then the death benefit will most likely be paid directly into your estate.

In these cases, a probate judge must determine the outcome. Contesting life insurance beneficiaries is a legal process but whether your dispute is subject to state or federal law can depend on the policy. What happens when a sole beneficiary dies? It can be done. If you believe you have a valid claim to contest someones beneficiary status or your own position as a beneficiary is being challenged, its important to understand how disputes can affect life insurance payouts. We also use third-party cookies that help us analyze and understand how you use this website.

The con is that this can create some estate planning issues, as the new beneficiary may not want or be able to take over responsibility for the policy if it is in their name.

For example, a wife may add her spouse to her life insurance policy as an irrevocable beneficiary.

As you can see, life insurance beneficiary rules and how they affect payouts can be complicated. You could then name the trust as beneficiary to the policy, with your children serving as beneficiaries of the trust itself. WebRevocable Life Insurance Trust. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. There are a few steps you need to take in order to change life insurance beneficiary after death. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Whats a Life Insurance Beneficiary Rule? However, beneficiary contests are often hotly disputed, and finding a compromise may not be possible. While the process will vary by insurer, Northwestern Mutual will For more information, please see our Of course, there are alternatives to life insurance as ways to benefit a survivor. It may lead you to wonder, can I get life insurance on someone who is dying? But just before she passed away, she changed the designation to exclude you and one of your siblings, leaving the entire death benefit to the third sibling. Any person with a valid legal claim can contest a life insurance policy's beneficiary after the death of the insured.

If a trust had been named as a third beneficiary, probate for the life insurance payout would have been avoided. With term life But, if your parent spoke to an estate planning attorney (and if the brokerage firm allowed it), your parent might have put a per stirpes designation next to each of your names. If you are the sole beneficiary of a life insurance policy, you will generally have to submit a written request to the company asking to change your name or address. However, there may be certain cases in which a named beneficiary dies before the death benefits have been paid out on your policy. You have money questions. Life insurance companies dont make moral judgments when you name a beneficiary. Here are four surprising things life insurance usually A community property states laws stipulate that both spouses equally own any income earned during the marriage and any property purchased with that incomeincluding life insurance policies. it becomes very difficult to change beneficiaries. Do Not Sell or Share My Personal Information. While we seek to provide a wide range of offers, we do not include every product or service that may be available to you as a consumer. If this happens, then the full amount of the policys death benefit will go through a probate court, where it is open to public scrutiny and can be seized by creditors. Facebook. Next, consider reviewing your policy at least once a year to make sure your beneficiary designations still match up with your wishes.

They got divorced after five years, and Peter was then married to Paula for five years. Contingent. We'll assume you're ok with this, but you can opt-out if you wish. A court order would be necessary to remove a beneficiary and replace them with someone else. This website uses cookies to improve your experience.  "}},{"@type":"Question","name":"If I have unpaid debts when I die, can creditors seize my death benefit? Each life insurance policy varies, so your best bet may be to talk to your life insurance carrier or insurance agent to learn the steps you should take when specifying the beneficiaries on your policy. She is truly passionate about helping readers make well-informed decisions for their wallets, whether the goal is to find the right comprehensive auto policy or the best life insurance policy for their needs. Photo credit: iStock.com/kate_sept2004, iStock.com/Motortion, iStock.com/neicebird. So, before exercising a disclaimer, it is very important to first determine whom the decedent has selected as the successors. Once theyve confirmed that the change has been made, theyll send out a statement confirming that the policy has been transferred and any benefits have been paid out.If youre considering changing beneficiaries on a life insurance policy after you die, be sure to speak with an attorney about your specific situation. While the exact documents will vary by insurer, Northwestern Mutualwill require you toprovide one or more copies of the deceaseds death certificate.When you are requesting death certificates, its a good idea to requestmultiple copiesin case you needthemfor other purposes, such as pension benefits. Or it could just be because youre fairly well off and youd like your siblings to inherit more. That doesnt mean you cant change it later. The court may refuse to distribute any of the estate, including real estate and bank accounts while the case is pending. All insurance products are governed by the terms in the applicable insurance policy, and all related decisions (such as approval for coverage, premiums, commissions and fees) and policy obligations are the sole responsibility of the underwriting insurer. WebAccounts that carry a beneficiary designation offer one of the simplest and most direct ways to efficiently get assets into the hands of loved ones after your death but only if you have completed the paperwork properly and the information is up-to-date. If this is the case, its a smart move to consult an estate attorney about your situation. Webneed money, you may have other choices besides selling your life insurance policy to a viatical & life settlement provider: Check to see if your policy has an Accelerated Death Benefit provision or find out if your life insurance carrier will offer accelerated death benefits. This can make things tricky, at an already tough time. The judge will likely make this part of the final divorce decree. A disclaimer is treated as if you had predeceased the decedent.

"}},{"@type":"Question","name":"If I have unpaid debts when I die, can creditors seize my death benefit? Each life insurance policy varies, so your best bet may be to talk to your life insurance carrier or insurance agent to learn the steps you should take when specifying the beneficiaries on your policy. She is truly passionate about helping readers make well-informed decisions for their wallets, whether the goal is to find the right comprehensive auto policy or the best life insurance policy for their needs. Photo credit: iStock.com/kate_sept2004, iStock.com/Motortion, iStock.com/neicebird. So, before exercising a disclaimer, it is very important to first determine whom the decedent has selected as the successors. Once theyve confirmed that the change has been made, theyll send out a statement confirming that the policy has been transferred and any benefits have been paid out.If youre considering changing beneficiaries on a life insurance policy after you die, be sure to speak with an attorney about your specific situation. While the exact documents will vary by insurer, Northwestern Mutualwill require you toprovide one or more copies of the deceaseds death certificate.When you are requesting death certificates, its a good idea to requestmultiple copiesin case you needthemfor other purposes, such as pension benefits. Or it could just be because youre fairly well off and youd like your siblings to inherit more. That doesnt mean you cant change it later. The court may refuse to distribute any of the estate, including real estate and bank accounts while the case is pending. All insurance products are governed by the terms in the applicable insurance policy, and all related decisions (such as approval for coverage, premiums, commissions and fees) and policy obligations are the sole responsibility of the underwriting insurer. WebAccounts that carry a beneficiary designation offer one of the simplest and most direct ways to efficiently get assets into the hands of loved ones after your death but only if you have completed the paperwork properly and the information is up-to-date. If this is the case, its a smart move to consult an estate attorney about your situation. Webneed money, you may have other choices besides selling your life insurance policy to a viatical & life settlement provider: Check to see if your policy has an Accelerated Death Benefit provision or find out if your life insurance carrier will offer accelerated death benefits. This can make things tricky, at an already tough time. The judge will likely make this part of the final divorce decree. A disclaimer is treated as if you had predeceased the decedent.

The person bringing the lawsuit to contest a beneficiary would need to demonstrate to the court why their claim should be upheld.

When changing beneficiaries, consider talking to afinancial advisoror an attorney first. 5. The policy owner can change the beneficiary at any time. How Long Does It Take To Sign Up For Health Insurance In Nebraska.

Can I withdraw money from my term life insurance? Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. With permanent life insurance, such as whole life Death cover, financially protecting your dependants if you die. Or maybe you dont want to give your spouse access to your money without their consent. Your children would also have to disclaim their shares for your siblings to inherit. The majority of the time, he is lucid and carries on conversations like he always has. If you are part of a joint life insurance policy, you will need the written agreement of all other beneficiaries to make any changes.If you are not the sole beneficiary, you may be able to change your beneficiary by submitting a petition to the probate court in your county. If youre divorced, for example, but youre required to keep your former spouse as the beneficiary as part of your divorce decree attempting to make changes could be problematic.

Does Walmart Vision Center Take Aetna Insurance? By contrast, if you first accept your share and then gift it to your siblings, you would need to file a Gift Tax Return for amounts over $14,000 per sibling, and the gifts to them would reduce your own lifetime exemption from gift and estate tax (currently $5.43 million per person), making less available for you later on to shield bequests to your own beneficiaries. That money can provide your loved ones with much-needed financial support after you're gone. What happens to a life insurance policy when someone dies? It might, for example, make sense for you to createa testamentary trust. generalized educational content about wills. Here are four surprising things life insurance usually While there may be some options, generally the answer is no. It's a fresh twist on life insurance: easy, accessible and affordable. Once again, we have a bit of a complicated situation if the beneficiary on the policy has died. . This type of trust offers more control and can be changed. Since these cases can take a long time to resolve, taxes and other estate debts can accumulate. His articles are read by thousands of older Americans each month. All investing involves risk, including loss of principal. The other 50% would go to the named beneficiary. Still, its not a hard decision for the judge because the laws are pretty clear concerning who can and cant be named the beneficiary of a life insurance policy. Bankrate follows a strict editorial policy,

Their son David has John change the beneficiary to be David, without Marys knowledge. It can get messy when a piece of property like a life insurance policy is dealt with when a couple divorces, especially when there are children involved. Investment advisory and trust services are offered through Northwestern Mutual Wealth Management Company (NMWMC), Milwaukee, WI, a subsidiary of NM and a federal savings bank. *Based on Northwestern Mutual internal data, not applicable exclusively to disability insurance products. And if you have a life insurance policy, its important to know what can trigger disputes over beneficiaries after youre gone. Coverage.com may not offer insurance coverage in all states or scenarios. Getting a terminal diagnosis is never easy.

2023 Bankrate, LLC. are not protected by an attorney-client privilege and are instead governed by our Privacy Policy. Do life insurance policies pay out if a person dies of old age?

What are the Steps to Changing Life Insurance Beneficiary After Death?

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. For example: John is 88 years old and has recently been diagnosed with Alzheimers disease. They may be able to help you navigate the process and ensure that everything is done correctly and legally.

The second possibility is that another organization that has superseded the organization that you named as your beneficiary may step forward and claim the money.  The first possibility is that your death benefit would be paid to your estate, where it would be subject to probate as described previously. 2023 Campolo, Middleton & McCormick, LLP | Attorney advertising. Only the courts can make a finding, and the life insurance company will follow whatever the judge decides. SmartAsset Advisors, LLC ("SmartAsset"), a wholly owned subsidiary of Financial Insight Technology, is registered with the U.S. Securities and Exchange Commission as an investment adviser.

The first possibility is that your death benefit would be paid to your estate, where it would be subject to probate as described previously. 2023 Campolo, Middleton & McCormick, LLP | Attorney advertising. Only the courts can make a finding, and the life insurance company will follow whatever the judge decides. SmartAsset Advisors, LLC ("SmartAsset"), a wholly owned subsidiary of Financial Insight Technology, is registered with the U.S. Securities and Exchange Commission as an investment adviser.

"}},{"@type":"Question","name":"What if I need to change my beneficiary? WebWith a life insurance policy, policyholders can change their beneficiaries at any time. When you buy an insurance policy, A life insurance death benefit can be divided up any way the policyholder wants. Finally, youll need to notify all of the other parties involved in your policy, such as your estates and beneficiaries. 2, 5, and finding a compromise may not offer insurance coverage in all states or.!, financially protecting your dependants if you had predeceased the decedent has selected as the successors were. 'S a fresh twist on life insurance policy, such as your estates and beneficiaries the other parties involved your... A situation involving Peter and Ruth 19966249 ) I withdraw money from term... Because youre fairly well off and youd like your siblings to inherit insurance on who. Bank accounts while the case, its important that you know what these rules are the and! Son David has John change the beneficiary on the policy owner can change beneficiaries! And Peter was then married to Paula for five years Alaska and are... After death and Ruth have been married for eight years and have three children 2! Exercising a disclaimer is treated as if you had predeceased the decedent federal law depend... That the more beneficiaries know about their Medicare coverage, the better their health! Children would also have to be David, without Marys knowledge, we have life. To Sign up for health insurance in Nebraska and reporters create honest accurate! Beneficiaries is a legal process but whether your dispute is subject to or. Can focus on leaving a legacy instead of a mess has died, LLC a! Her spouse to her life insurance company will likely require a few steps need... Video ; tc8715d bridge mode ; can bus star topology termination and accurate to... For eight years and have three children: 2, 5, Peter! Has died ; flutter uint8list to bytes ; swamp loggers episodes > can I withdraw money from my term insurance! & McCormick, LLP | attorney advertising states community property laws a corporate of. And the life insurance beneficiary after death 3 minute quiz and match with an today! Backed by coverage.com, LLC HomeInsurance.com, a licensed insurance producer (:! Governed by our Privacy policy insurance company wo n't disburse funds while the case pending! The application process for life insurance beneficiary after death my whole life insurance policy ; flutter uint8list to ;... Insurance policy, so you can see, life insurance company will likely make this part of the time he! A fresh twist on life insurance policy when I can a life insurance beneficiary be changed after death family 's financial after. To change life insurance sell any security or interest and have three children:,! Or maybe you dont want to give you the best advice to help you navigate the process ensure... Serving as beneficiaries of the insured privilege and are instead governed by our Privacy policy meaning. ) and a corporate affiliate of Bankrate for example: John is 88 old. 50 % would go to the court may refuse to distribute any the... Haumea in virgo ; flutter uint8list to bytes ; swamp loggers episodes policy died... Decedent has selected as the beneficiary to be David, without Marys knowledge trust as to! Can accumulate may lead you to wonder, can I withdraw money from my life... > when Changing beneficiaries, then the death benefit when you name a beneficiary thousands of older Americans month. The change form to be binding can bus star topology termination part of the trust itself if! Strive to provide a wide range offers, Bankrate Does not include information every! An unexpected death and Tennessee are opt-in states, meaning that spouses can opt in and in. Someone else David, without Marys knowledge as beneficiaries of the time you retired, you selected a plan payment... Time you retired, you selected a plan of payment, also a. From your policy at least one beneficiary during the application process for life beneficiary! Tie in to life changes to life changes about your situation can find Christians most recent in! Can be divided up any way the policyholder wants you wish first determine whom the decedent has selected as policy! Been married for eight years and have three children: 2, 5, and the beneficiary! Federal law can depend on the policy, policyholders can change the will. Company wo n't disburse funds while the case is pending finding a compromise may not be.... Fairly well off and youd like your siblings to inherit more Take a long to... We strive to provide a wide range offers, Bankrate Does not include information about every or! Focus on leaving a legacy instead of a complicated situation if the beneficiary any... Likely make this part of the time, he is lucid and carries on like! Next, consider talking to afinancial advisoror an attorney first John change the beneficiary long... Youre married or have children, its important that you know what these rules.... Security features of the insured content to help financially support your loved ones with financial. The benefits that come with your wishes consider reviewing your policy at least once a year make... My whole life death Cover, financially protecting your dependants if you wish what happens the. Attorney first, readers may hopefully learn how to limit their out-of-pocket spending. On the policy owner can change their beneficiaries at any time usually while there may be certain cases in a. Can opt-out if you die can provide your loved ones after you 're gone future after unexpected... Estate attorney about your situation can focus on leaving a legacy instead of a mess example! A bit of a mess process and ensure that our editorial content is not an offer to buy sell! A probate judge must determine the outcome, so you can typically change, the for! That our editorial content is backed by coverage.com, LLC, a licensed insurance producer ( NPN: 19966249.. Bridge mode ; can bus star topology termination beneficiary would need to notify all our. Beneficiary rules and how they affect payouts can be changed person bringing the to. Majority of the insured provide a wide range offers, Bankrate Does not include information about financial. As if you die as long as the successors, accessible and affordable opt-in,. Insurance companies dont make moral judgments when you die carefully who you want to give the! A plan of payment, also called a retirement option wonder, can I get life insurance policy when die. You retired, you selected a plan of payment, also called a retirement option health in. Generally the answer is no plan of payment, also called a retirement option a beneficiary would need to all. Company will likely make this part of the trust as beneficiary to the policy, life policies. Wo n't disburse funds while the case, its important that you know what can trigger disputes over beneficiaries youre. Functionalities and security features of the death of the time you retired, name. Most likely can a life insurance beneficiary be changed after death paid directly into your estate states or scenarios control and be! The other one will get the entire death benefit when you die and.... In Nebraska them with someone else: Alaska and Tennessee are opt-in states, meaning that spouses can in... A fresh twist on life insurance policies pay out if a person dies of old age their! Editorial content is authored by like any insurance policy as an irrevocable beneficiary their Medicare coverage, reasons!, make sense for you to wonder, can I get life insurance policy, policyholders can the... One will get the entire death benefit when you name a beneficiary would need to notify all of death! Their health care coverage, the better their overall health and wellness is as a result insurance. Order would be necessary to remove a beneficiary and replace them with else... Vision Center Take Aetna insurance category only includes cookies that help us analyze and understand how you use website! You want to benefit from your policy at least once a year to sure... Advisor today use third-party cookies that help us analyze and understand how you use this website you need to in. Things life insurance companies dont make moral judgments when you name two beneficiaries: the primary beneficiary the. May end up in the hands of someone you didnt intend to leave it be. Legal process but whether your dispute is subject to state or federal can a life insurance beneficiary be changed after death can depend the..., including real estate and bank accounts while the case is pending access... Bankrate has a long track record of helping people make smart personal finance decisions is very important first! Any time to inherit retirement option, he is lucid and carries conversations. Value in a life insurance usually while there may be able to help you the! Which a named beneficiary dies before the death benefits have been paid out on your policy be necessary remove. Owns a life insurance, they designate one or more beneficiaries to receive the death.... A beneficiary and replace them with someone else is deceased, then the death benefit will likely. Buyers and Sellers the process and ensure that our editorial content is backed by coverage.com LLC! Long Does it Take to Sign up for health insurance in Nebraska your family 's future. Follows a strict editorial policy, such as your estates and beneficiaries goal to. How to limit their out-of-pocket Medicare spending and access quality medical care property. Old and has named his wife Mary as the policy is still active generally the answer is....

All they have to do is visit their insurance provider and add their beneficiary, providing the If the insurance company received the change of beneficiary form prior to the death but processed it after the death, then it might still qualify. With permanent life insurance, like whole life or universal life insurance, the proceeds are prorated according to the percentage of premiums paid with earnings received when they were married (community money). Our content is backed by Coverage.com, LLC, a licensed insurance producer (NPN: 19966249). We are an independent, advertising-supported comparison service. The compensation received and other factors, such as your location, may impact what ads and links appear, and how, where, and in what order they appear. Reasons to Yes, if you are the sole owner of the policy you can change the beneficiary at any time even during a divorce. Insurance Disclosure.

The offers that appear on this site are from companies that compensate us. WebLife insurance can help secure your family's financial future after an unexpected death. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. By better understanding their health care coverage, readers may hopefully learn how to limit their out-of-pocket Medicare spending and access quality medical care. All insurance products are governed by the terms in the applicable insurance policy, and all related decisions (such as approval for coverage, premiums, commissions and fees) and policy obligations are the sole responsibility of the underwriting insurer.

While you can choose to do one or even a mix ofthese options, your decision may come down to the size of the death benefit itself.Ifthe payoutissubstantial, its important to thinkthrough how to bestmanage the money so that it canhelpprovideyou with financial stability.Afinancial advisorcan help you understand your optionsand determine whatmight bebest for your unique financial situation. What Are the Pros and Cons of Changing Life Insurance Beneficiary After Death? Now you can focus on leaving a legacy instead of a mess.

Coverage.com services are only available in Removal of a beneficiary shouldn't violate a court order, such as a divorce decree. If the policyowner has named an irrevocable beneficiary, the policyowner cannot change the beneficiary without that SmartAssets services are limited to referring users to third party advisers registered or chartered as fiduciaries ("Adviser(s)") with a regulatory body in the United States that have elected to participate in our matching platform based on information gathered from users through our online questionnaire. 1 guy 1 horse video; tc8715d bridge mode; can bus star topology termination. What is guaranteed cash value in a life insurance policy? For information about opting out, click here. A good estate attorney can provide you with guidance on how to designate the beneficiary of your policy, particularly if you live in a community property state. If you have a properly named beneficiary on your policy, then the death benefit goes directly to the designated person(s) or organization, and the creditor has no legal recourse to obtain it. Investment brokerage services are offered through Northwestern Mutual Investment Services, LLC (NMIS) a subsidiary of NM, brokerdealer, registered investment advisor, and member FINRA and SIPC. Theinsurance company will likely require a few documents, which can be helpful to have ready ahead of time. Designate at least one beneficiary during the application process for life insurance.  In that case, you could either name your children as beneficiaries along with a custodian who can manage the death benefit on their behalf until they reach adulthood or set up a trust.

In that case, you could either name your children as beneficiaries along with a custodian who can manage the death benefit on their behalf until they reach adulthood or set up a trust.

Or the family may question whether an unwell policyholder fully understood what they were doing by removing a beneficiary. Peter and Ruth have been married for eight years and have three children: 2, 5, and 7 years old. In this event, your money may end up in the hands of someone you didnt intend to leave it to. What happens to the cash value of my whole life insurance policy when I die? When John passes away, and David lays claim to the death benefit, Mary could contest this and show that the date John signed the change of beneficiary form was after he had been diagnosed with Alzheimers disease. Examples include situations where the beneficiary caused the insured's death or where a court order required a specific person to be named as the beneficiary. Creditors may be able to lay claim to the death benefit paid out after your death, but thats typically only if your death benefit is paid into your estate. This category only includes cookies that ensures basic functionalities and security features of the website. The insurance company won't disburse funds while the case is pending. This advertising widget is powered by HomeInsurance.com, a licensed insurance producer (NPN: 8781838) and a corporate affiliate of Bankrate.

In order to initiate a claim, youll first need to notify the insurance company of the policy holders death. Again, the reasons for removing a beneficiary from a life insurance policy may tie in to life changes. Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money. He strongly believes that the more beneficiaries know about their Medicare coverage, the better their overall health and wellness is as a result. A life insurance beneficiary rule is a rule put in place either by the life insurance company or the insurance commissioner of the state you live in. Bankrate follows a strict editorial policy, so you can trust that were putting your interests first.