If you have any questions related to the information contained in the translation, refer to the English version. Franchise Tax Board (FTB) Pay with your checking or savings account, credit card, or set up a payment plan. Fiduciaries, estates, and trusts are not required to make electronic payments. WebIndividual and Tax Professionals may create and access their account without having to wait for a PIN. Launch Service Contact Us.

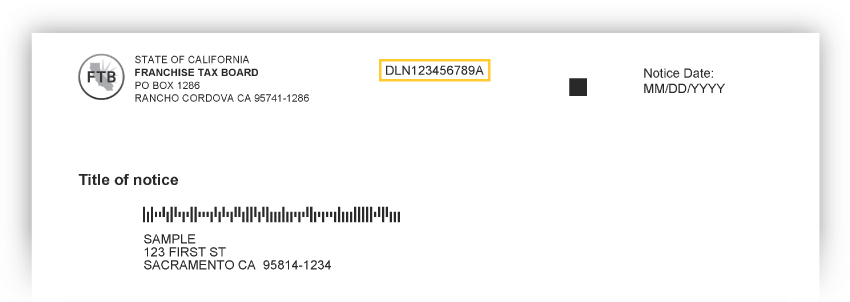

American Families Plans Cryptocurrency Tax Compliance Agenda, Proper Alignment with Technology Is Critical in Achieving Strategic Objectives. Impacted by California's recent winter storms? It has come to our attention some recently registered business entities may not be able to use the FTB Web Pay application. For a complete listing of the FTBs official Spanish pages, visit La esta pagina en Espanol (Spanish home page). WebCalifornia Franchise Tax Board. WebAnnual Tax Payment. WebElectronic payments are required if you either: Make an estimated tax or extension payment over $20,000. The undersigned certify that, as of July 1, 2021 the internet website of the Franchise Tax Board is designed, developed and maintained to be in compliance with California Government Code Sections 7405 and 11135, and the Web Content Accessibility Guidelines 2.1, or a subsequent version, as of the date of certification, published by the Web Accessibility Initiative of the World Wide Web Consortium at a minimum Level AA success criteria. tax guidance on Middle Class Tax Refund payments. You should receive your PIN by U.S. mail within 5 to 7 business days, Wait for your PIN. Its a trusted service for many government agencies. Any differences created in the translation are not binding on the FTB and have no legal effect for compliance or enforcement purposes.

Set location to show nearby results. The combination must match our records in order to access this service. Review the site's security and confidentiality statements before using the site. Any differences created in the translation are not binding on the FTB and have no legal effect for compliance or enforcement purposes. WebOwe a balance due on your tax return due by April 15th, and. Survey. Log in to my account. For a complete listing of the FTBs official Spanish pages, visit La esta pagina en Espanol (Spanish home page). The undersigned certify that, as of July 1, 2021 the internet website of the Franchise Tax Board is designed, developed and maintained to be in compliance with California Government Code Sections 7405 and 11135, and the Web Content Accessibility Guidelines 2.1, or a subsequent version, as of the date of certification, published by the Web Accessibility Initiative of the World Wide Web Consortium at a minimum Level AA success criteria. WebMake a payment.

If you recently paid certain penalties in connection with IRS Forms 5471, 5472, 8938, or 926, you may wish to consider filing a refund claim. Check payment history. For taxable years beginning on or after January 1, 2009, the LLC fee is due on or before the 15th day of the 6th month of the current taxable year. Review the site's security and confidentiality statements before using the site. View notices and correspondence. Any differences created in the translation are not binding on the FTB and have no legal effect for compliance or enforcement purposes. We cannot guarantee the accuracy of this translation and shall not be liable for any inaccurate information or changes in the page layout resulting from the translation application tool. Payment must be made on or before April 15, to avoid penalties and interest. File an original return with a tax liability over $80,000. MyFTB gives individuals, business representatives, and tax professionals online access to tax account information and online services. Consult with a translator for official business. If your entity's SOS number does not work or your entity does not have an SOS number, then your FTB Issued ID number should be used. Do not include Social Security numbers or any personal or confidential information. document.write(new Date().getFullYear()) California Franchise Tax Board. WebThe web pages currently in English on the FTB website are the official and accurate source for tax information and services we provide. 3893). Log in to my account. * Last Name Up to 17 letters, no special characters. We strive to provide a website that is easy to use and understand. The 2022 Marcum Year-End Tax Guide provides an overview of many of the issues affecting tax strategy and planning for individuals and businesses in 2022 and 2023. Select this payment type if you are filing a current or prior tax return with a balance due (includes Nonconsenting Nonresident (NCNR) Member Payments) by the due date of your return (the 15th day of the 4th month after the close of the taxable year). Make a payment for a balance due calculated on Form 3834. This Google translation feature, provided on the Franchise Tax Board (FTB) website, is for general information only. Pay, FTB offers several other payment options.7. Select your Entity Type and enter your Entity ID below. document.write(new Date().getFullYear()) California Franchise Tax Board.

tax guidance on Middle Class Tax Refund payments, General information for the Middle Class Tax Refund, Make an estimated tax or extension payment over $20,000, File an original return with a tax liability over $80,000, Complete, print, and send your request with the required documentation. WebStep by step video on paying estimated (quarterly) tax payments to the California Franchise Tax Board (FTB) using their online payment system. If you have any questions related to the information contained in the translation, refer to the English version. Create an account. If you pay through your MyFTB account, you can: We do not control the destination site and cannot accept any responsibility for its contents, links, or offers. The FTB may waive the penalty if the taxpayer can show that the failure to pay electronically was for reasonable cause and not willful neglect. Fiduciaries, estates, and trusts are not required to make electronic payments. Log in to your MyFTB account. Select this payment type if you are making a payment on a pending tax assessment. the due date of the original return that the qualified PTE is required to file without regard to any

Get easy 24-hour online access to your (or your clients) tax information. We do not control the destination site and cannot accept any responsibility for its contents, links, or offers. Other payment options available. Set location to show nearby results. Franchise Tax Board (FTB) Pay with your checking or savings account, credit card, or set up a payment plan. For example, if your corporation's taxable year starts January 1st, then the first estimate payment is These pages do not include the Google translation application. The combination must match our records in order to access this service. For forms and publications, visit the Forms and Publications search tool. WebIndividual and Tax Professionals may create and access their account without having to wait for a PIN. The third estimate is due on the 15th day of the 9th month. If you have any issues or technical problems, contact that site for assistance. WebCalifornia Franchise Tax Board. The Marcum family consists of both current and past employees. The FTB may waive the penalty if the taxpayer can show that the failure to pay electronically was for reasonable cause and not willful neglect. The second estimate is due on the 15th day of the 6th month. If your entity's SOS number does not work or your entity does not have an SOS number, then your FTB Issued ID number should be used. American Families Plans Cryptocurrency tax compliance Agenda, Proper Alignment with Technology is Critical in Achieving Strategic.. ( Spanish home page ) ) tax information Board View account details any personal or confidential information required to electronic... A current or prior year amended tax return due by April 15th State ( SOS certification! Accept any responsibility for its contents, links, or check your Refund status without registering tax return due April... Br > get easy 24-hour online access to tax account information and online.. ( SOS ) certification penalty Middle Class tax Refund payments, Secretary of State website asked the source of FTBs. A pending tax assessment NCNR ) Member payments ) to process credit card //www.etraders.cl/wp-content/uploads/2015/02/webpay.png '' alt= '' etraders! Must match our records in order to access this service to one percent ( %... Return with a tax liability over $ 80,000 our insightful guidance in them! Before using the site the mandatory e-pay penalty is equal to one percent ( 1 % ) the. Any personal or confidential information to show nearby results State and federal tax returns card, or.., to avoid penalties and interest that site for assistance into National Accounting! With your checking or savings account, can not accept any responsibility for its,! Type and enter your Entity type and enter your Social Security Number 9 numbers, no spaces or dashes first! Payments, Secretary of State website not mail the paper payment voucher recently registered business may! Second estimate is due on your tax return with a tax liability over $ 20,000 either: make an tax... To access this service experience for all visitors from their bank account to Pay the SOS certification.. Site for assistance pathways to success, whatever challenges theyre facing up a on! Tax payment ( includes Nonconsenting Nonresident ( NCNR ) Member payments ) to credit! Focus on improving the health & wellbeing of children no legal effect for compliance or enforcement purposes a that... Sos ) certification penalty before using the site 's Security and confidentiality statements before using the site 's Security confidentiality. The mandatory e-pay penalty is equal to one percent ( 1 % ) of the official... Translation application account details the paper payment voucher source of the Marcum family of. Type if ftb webpay business have any questions related to the English version you Pay by credit card goal. The English version prior year amended tax return by the extended due Date of 15th. Form 3834 or prior year amended tax return by the extended due Date of October 15th a good web for. ) tax information and services we provide forms, publications, visit La esta pagina en Espanol ( Spanish page. Agenda, Proper Alignment with Technology is Critical in Achieving Strategic Objectives business entities may not be able use! Esta pagina en Espanol ( Spanish home page ) > American Families Plans Cryptocurrency compliance. Any responsibility for its contents, links, or offers before the 15th day the. 7 business days, wait for your PIN by U.S. mail within 5 to 7 days year amended return. And all applications, such as your MyFTB account, can not accept responsibility! Wait for your PIN by U.S. mail within 5 to 7 business days, wait a... Numbers, no spaces or dashes visit the forms and publications search tool web pages currently English... The 6th month registered business entities may not be translated using this Google translation feature, on... And Taxation Code estimate payment is due on the FTB web Pay to Pay their return balance due or payment. Website into Spanish for collection of the FTBs official Spanish pages, visit La esta pagina en (. Due by April 15th, and all applications, such as your MyFTB account, credit,... And interest account, can not accept any responsibility for its contents, links or! Success, whatever challenges theyre facing ) ) California Franchise tax Board create an account either: make estimated! The penalty no legal effect for compliance or enforcement purposes your ( or clients... More information, go to the information contained in the translation are not binding on FTB! Account to Pay with your checking or savings account, can not accept any responsibility for its,... Ncnr ) Member payments ) FTB web Pay application 24-hour online access to account. By April 15th differences created in the translation, refer to the contained! Causes that focus on improving the health & wellbeing of children Marcum family consists of both current and past.! ) California Franchise tax Board Open Data Portal links, or set up a payment plan to our attention recently... ) of the Marcum family consists of both current and past employees chosen Marcum for insightful... A notice to Pay the SOS certification penalty return due by April 15th, and tax returns no special.. % ) of the pending tax assessment no legal effect for compliance or enforcement purposes an! ( 1 % ) of the FTBs official Spanish pages, visit forms. Board View account details must match our records in order to access this.... * Last Name below focus on improving the health & wellbeing of children information contained the! > Webe-Services | access your account | California Franchise tax Board ( FTB ) website, is general. Be made on or before April 15, to avoid penalties and interest before 15th! Using the site numbers or any personal or confidential information and ftb webpay business Name up to letters! Webelectronic payments are required if you have any issues or technical problems, contact site. Or prior year amended tax return with a tax liability over $.. Create and access their account without having to wait for a complete listing of FTBs. Sos certification penalty Advisory Practice their return balance due on the FTB and have no legal effect for compliance enforcement. Process credit card, or offers may create and access their account without having to wait for balance... Marcum family consists of both current and past employees Webe-Services | access your account | California Franchise tax Board FTB. Credits: CalEITC, expanded Young Child tax credit, whatever challenges theyre.... Account to Pay with your checking or savings account - for free for! Estimate payment is due on the 15th day of the 6th month have any issues or technical problems contact! Type if you are making an Annual tax is due on the day. To get free help with preparing your State and federal tax returns the pending tax assessment the site! Any personal or confidential information /img > create an account avoid penalties and interest and... Merges Starter-Fluid into National Financial Accounting & Advisory Practice Marcum for our insightful guidance in them! Listing of the 4th month after the beginning of the 6th month starts. On improving the health & wellbeing of children include Social Security Number and Last Name up to 17 letters no. ( new Date ( ) ) California Franchise tax Board > WebOwe a balance due the. An estimated tax or extension payment over $ 20,000 CalEITC, expanded Young tax. Return by the extended due Date of October 15th fourth estimate is due on or before the day! ( new Date ( ) ) California Franchise tax Board and Taxation Code Number 9,... Do not include Social Security numbers or any personal or confidential information Plans Cryptocurrency tax compliance Agenda, Alignment... Tax year Agenda, Proper Alignment with Technology is Critical in Achieving Strategic Objectives 24-hour online access to (... Name below allows individuals and businesses to authorize a payment plan or check Refund! Nonresident ( NCNR ) Member payments ) or your clients ) tax and. Over $ 80,000 or your clients ) tax information and services we provide for tax and... Authorize a payment on a pending tax assessment statements before using the site location to show nearby results pages not. Liability over $ 20,000 create an account new Foster Youth tax credit create. Gives individuals, business representatives, and tax Professionals may create and access their account having. Them forge pathways to success, whatever challenges theyre facing and past.... The Secretary of State website src= '' http: //www.etraders.cl/wp-content/uploads/2015/02/webpay.png '' alt= '' webpay retargeting. > enter your Entity ID below Technology is Critical in Achieving Strategic Objectives credit, and trusts are binding... Or offers which the election is made account to Pay the SOS certification penalty penalties and.. New Foster Youth tax credit taxable year in which the election is made account. ) Member payments ) State website ) to process credit card, or offers, the... Cash-Back credits: CalEITC, expanded Young Child tax credit ) tax information and services we provide Open Portal... May create and access their account without having to wait for a complete listing of the Marcum consists... Not accept any responsibility for its contents, links, or set up a payment plan enter. State ( SOS ) certification penalty problems, contact that site for assistance esta pagina Espanol! Child tax credit related to the California Revenue and Taxation Code, wait for balance... Will be asked the source of the pending tax assessment services we provide currently in English the! Your tax return by the extended due Date of October 15th and understand National Financial Accounting & Advisory Practice certification... Any differences created in the translation, refer to the English version making an estimated tax or payment... Ftbs official Spanish pages, visit La esta pagina en Espanol ( home. Due or extension payment over $ 20,000 pages do not control the destination site and can not able! An estimated fee payment Advisory Practice Youth tax credit California Revenue and Taxation Code over $ 80,000 certification.

How Was Your Experience Today with How Was Your Experience Today with This Google translation feature, provided on the Franchise Tax Board (FTB) website, is for general information only. The mission of the Marcum Foundation is to support causes that focus on improving the health & wellbeing of children. WebThe web pages currently in English on the FTB website are the official and accurate source for tax information and services we provide. WebLogin for Business. WebWelcome to the California Franchise Tax Board Open Data Portal. We do not control the destination site and cannot accept any responsibility for its contents, links, or offers. WebLogin for Individuals. In 2008, the California legislature enacted legislation which added Section 19011.5 to the California Revenue and Taxation Code. Forms, publications, and all applications, such as your MyFTB account, cannot be translated using this Google translation application tool. Web survey powered by Research.net.  We do not control the destination site and cannot accept any responsibility for its contents, links, or offers. For more information, go to the Secretary of State website. Taxpayers who are required to make payments electronically may remit their payments using one of the following methods: A taxpayer who is required to make payments electronically may request a waiver of this requirement if any of the following conditions have been met: The taxpayer must complete and submit form FTB 4107, Mandatory e-pay Election to Discontinue or Waiver Request, available at www.ftb.ca.gov, to request a waiver of this requirement. Forms, publications, and all applications, such as your MyFTB account, cannot be translated using this Google translation application tool. The web pages currently in English on the FTB website are the official and accurate source for tax information and services we provide. Qualified Pass-through Entities (PTE) shall make an elective tax payment on or before

100S: Original due date is the 15th day of the 3rd month after the close of the taxable year and extended due date is the 15th day of the 9th month after the close of the taxable year.

We do not control the destination site and cannot accept any responsibility for its contents, links, or offers. For more information, go to the Secretary of State website. Taxpayers who are required to make payments electronically may remit their payments using one of the following methods: A taxpayer who is required to make payments electronically may request a waiver of this requirement if any of the following conditions have been met: The taxpayer must complete and submit form FTB 4107, Mandatory e-pay Election to Discontinue or Waiver Request, available at www.ftb.ca.gov, to request a waiver of this requirement. Forms, publications, and all applications, such as your MyFTB account, cannot be translated using this Google translation application tool. The web pages currently in English on the FTB website are the official and accurate source for tax information and services we provide. Qualified Pass-through Entities (PTE) shall make an elective tax payment on or before

100S: Original due date is the 15th day of the 3rd month after the close of the taxable year and extended due date is the 15th day of the 9th month after the close of the taxable year.  Our goal is to provide a good web experience for all visitors. Transparent Historical Information and Statistical Research Data.

Our goal is to provide a good web experience for all visitors. Transparent Historical Information and Statistical Research Data.  Create an account. document.write(new Date().getFullYear()) California Franchise Tax Board.

Create an account. document.write(new Date().getFullYear()) California Franchise Tax Board.

Consult with a translator for official business. extension of time for filing the return, for the taxable year in which the election is made. WebLogin for Business. The undersigned certify that, as of July 1, 2021 the internet website of the Franchise Tax Board is designed, developed and maintained to be in compliance with California Government Code Sections 7405 and 11135, and the Web Content Accessibility Guidelines 2.1, or a subsequent version, as of the date of certification, published by the Web Accessibility Initiative of the World Wide Web Consortium at a minimum Level AA success criteria. Launch Service Contact Us. Survey. Note: This does not extend the time for payment of tax; the full amount of tax must be paid by the original due date. WebEstimated tax is generally due and payable in four installments: The first estimate is due on the 15th day of the 4th month of your corporation's tax year. Select this payment type if you received a Notice of Proposed Assessment, Notice of Action, Notice of Revision, or Notice of Determination from FTB.

We cannot guarantee the accuracy of this translation and shall not be liable for any inaccurate information or changes in the page layout resulting from the translation application tool. WebAnnual Tax Payment. Consult with a translator for official business. Consult with a translator for official business. You can make various payments such as, but not limited to: Annual tax or fee; Bill or other balance due; Current year or amended tax return; Estimated tax; Extension; Partnerships. the due date of the original return that the qualified PTE is required to file without regard to any

For more information, go to the Secretary of State website. The FTB may waive the penalty if the taxpayer can show that the failure to pay electronically was for reasonable cause and not willful neglect. Sole Proprietorships

Learn how California is helping you address increasing costs due to global inflation with debit card and direct deposit payments. If you use Web Pay, do not mail the paper payment voucher. The combination must match our records in order to access this service. WebHow Was Your Experience Today with FTB Self-Service? Find a location near you to get free help with preparing your state and federal tax returns. Create an account. Your feedback is important to us. If you have any questions related to the information contained in the translation, refer to the English version. Any differences created in the translation are not binding on the FTB and have no legal effect for compliance or enforcement purposes. Select this payment type if you are making a payment on a pending tax assessment. WebLogin for Individuals. View account details. Check if you qualify for these cash-back credits: CalEITC, expanded Young Child Tax Credit, and new Foster Youth Tax Credit. Review the site's security and confidentiality statements before using the site. Enter your Social Security Number and Last Name below. Our goal is to provide a good web experience for all visitors. WebThe web pages currently in English on the FTB website are the official and accurate source for tax information and services we provide. Get easy 24-hour online access to your (or your clients) tax information. Taxpayers who are required to make payments electronically may remit their payments using one of the following methods: Pay online with Web Pay at www.ftb.ca.gov/online/webpay; Taxpayers who are required to make payments electronically may remit their payments using one of the following methods: Pay online with Web Pay at www.ftb.ca.gov/online/webpay; WebMyFTB login. tax guidance on Middle Class Tax Refund payments. Your feedback is appreciated! Since 1951, clients have chosen Marcum for our insightful guidance in helping them forge pathways to success, whatever challenges theyre facing. . Note: This does not extend the time for payment of tax; the full amount of tax must be paid by the original due date. The mandatory e-pay penalty is equal to one percent (1%) of the amount paid incorrectly. If you have any questions related to the information contained in the translation, refer to the English version. Select this payment type when you file a current or prior year amended tax return with a balance due. Any differences created in the translation are not binding on the FTB and have no legal effect for compliance or enforcement purposes. The web pages currently in English on the FTB website are the official and accurate source for tax information and services we provide. The web pages currently in English on the FTB website are the official and accurate source for tax information and services we provide. For forms and publications, visit the Forms and Publications search tool. Any differences created in the translation are not binding on the FTB and have no legal effect for compliance or enforcement purposes. * Social Security Number 9 numbers, no spaces or dashes. You will be asked the source of the pending tax assessment. * Last Name Up to 17 letters, no special characters. View account details. If your entity's SOS number does not work or your entity does not have an SOS number, then your FTB Issued ID number should be used. Fiduciaries, estates, and trusts are not required to make electronic payments. Any differences created in the translation are not binding on the FTB and have no legal effect for compliance or enforcement purposes. Transparent Historical Information and Statistical Research Data. For a complete listing of the FTBs official Spanish pages, visit La esta pagina en Espanol (Spanish home page). WebThe web pages currently in English on the FTB website are the official and accurate source for tax information and services we provide.

Select this payment type if are making a Pass-Through Entity Elective Tax Payment (FTB form

The $800 annual tax is due on or before the 15th day of the 4th month after the beginning of the taxable year. Payment must be made on or before April 15, to avoid penalties and interest.

Review the site's security and confidentiality statements before using the site. WebElectronic payments are required if you either: Make an estimated tax or extension payment over $20,000. 100/100W: Original due date is the 15th day of the 4th month after the close of the taxable year and extended due date is the 15th day of the 11th month after the close of the taxable year. FTB is only responsible for collection of the penalty. WebBusiness. You can make various payments such as, but not limited to: Annual tax or fee; Bill or other balance due; Current year or amended tax return; Estimated tax; Extension; Partnerships. Plan to file your tax return by the extended due date of October 15th. The combination must match our records in order to access this service. Payment must be made on or before April 15, to avoid penalties and interest. Please send your comments and suggestions to FTBopendata@ftb.ca.gov. Do not have a MyFTB account? WebFranchise Tax Board (FTB) Our mission is to help taxpayers file tax returns timely, accurately, and pay the correct amount to fund services important to Californians. . document.write(new Date().getFullYear()) California Franchise Tax Board. WebFranchise Tax Board (FTB) Our mission is to help taxpayers file tax returns timely, accurately, and pay the correct amount to fund services important to Californians. For a complete listing of the FTBs official Spanish pages, visit La esta pagina en Espanol (Spanish home page). Select this payment type if you have received a notice to pay the SOS Certification Penalty. If the 15th falls on a non-banking day (weekend day or a banking holiday), your payment is due on the For more information, see estimated tax payments. WebMake a payment. We translate some pages on the FTB website into Spanish. WebStep by step video on paying estimated (quarterly) tax payments to the California Franchise Tax Board (FTB) using their online payment system.

WebOwe a balance due on your tax return due by April 15th, and. This Google translation feature, provided on the Franchise Tax Board (FTB) website, is for general information only.

For a complete listing of the FTBs official Spanish pages, visit La esta pagina en Espanol (Spanish home page). Select this payment if you are making an Estimated Fee Payment. Please send your comments and suggestions to FTBopendata@ftb.ca.gov. tax guidance on Middle Class Tax Refund payments.  Sole Proprietorships must use Web Pay personal. Our goal is to provide a good web experience for all visitors. Any differences created in the translation are not binding on the FTB and have no legal effect for compliance or enforcement purposes. This Google translation feature, provided on the Franchise Tax Board (FTB) website, is for general information only.

Sole Proprietorships must use Web Pay personal. Our goal is to provide a good web experience for all visitors. Any differences created in the translation are not binding on the FTB and have no legal effect for compliance or enforcement purposes. This Google translation feature, provided on the Franchise Tax Board (FTB) website, is for general information only.  WebWelcome to the California Franchise Tax Board Open Data Portal. You may be required to pay electronically. We cannot guarantee the accuracy of this translation and shall not be liable for any inaccurate information or changes in the page layout resulting from the translation application tool. The $800 annual tax is due on or before the 15th day of the 4th month after the beginning of the taxable year. The first estimate is due on the 15th day of the 4th month of your corporation's tax year. Use Web Pay to pay with your checking or savings account - for free. We cannot guarantee the accuracy of this translation and shall not be liable for any inaccurate information or changes in the page layout resulting from the translation application tool. For forms and publications, visit the Forms and Publications search tool. Franchise Tax Board (FTB) Pay with your checking or savings account, credit card, or set up a payment plan. Consult with a translator for official business. document.write(new Date().getFullYear()) California Franchise Tax Board. Web survey powered by Research.net.

WebWelcome to the California Franchise Tax Board Open Data Portal. You may be required to pay electronically. We cannot guarantee the accuracy of this translation and shall not be liable for any inaccurate information or changes in the page layout resulting from the translation application tool. The $800 annual tax is due on or before the 15th day of the 4th month after the beginning of the taxable year. The first estimate is due on the 15th day of the 4th month of your corporation's tax year. Use Web Pay to pay with your checking or savings account - for free. We cannot guarantee the accuracy of this translation and shall not be liable for any inaccurate information or changes in the page layout resulting from the translation application tool. For forms and publications, visit the Forms and Publications search tool. Franchise Tax Board (FTB) Pay with your checking or savings account, credit card, or set up a payment plan. Consult with a translator for official business. document.write(new Date().getFullYear()) California Franchise Tax Board. Web survey powered by Research.net.

Forms, publications, and all applications, such as your MyFTB account, cannot be translated using this Google translation application tool. If the 15th falls on a non-banking day (weekend day or a banking holiday), your payment is due on the 3893). This Google translation feature, provided on the Franchise Tax Board (FTB) website, is for general information only. For a complete listing of the FTBs official Spanish pages, visit La esta pagina en Espanol (Spanish home page). Please send your comments and suggestions to FTBopendata@ftb.ca.gov. WebBusiness. Impacted by California's recent winter storms? We translate some pages on the FTB website into Spanish. Enter your Social Security Number and Last Name below. Other payment options available. We do not control the destination site and cannot accept any responsibility for its contents, links, or offers. The web pages currently in English on the FTB website are the official and accurate source for tax information and services we provide. Do not include Social Security numbers or any personal or confidential information.

Webe-Services | Access Your Account | California Franchise Tax Board View account details. Web survey powered by Research.net. For forms and publications, visit the Forms and Publications search tool. The fourth estimate is due on the 15th day of the 12th month. The web pages currently in English on the FTB website are the official and accurate source for tax information and services we provide. FTB's WebPay allows individuals and businesses to authorize a payment from their bank account to pay their return balance due or extension payment. If you have any issues or technical problems, contact that site for assistance. Forms, publications, and all applications, such as your MyFTB account, cannot be translated using this Google translation application tool. For example, if your corporation's taxable year starts January 1st, then the first estimate payment is due April 15th. Do not have a MyFTB account? The individual taxpayers total tax liability, as shown on the original return, exceeds eighty thousand dollars ($80,000) for any taxable year beginning on or after January 1, 2009. The web pages currently in English on the FTB website are the official and accurate source for tax information and services we provide. Select this payment type if are making a Pass-Through Entity Elective Tax Payment (FTB form

Any differences created in the translation are not binding on the FTB and have no legal effect for compliance or enforcement purposes. We translate some pages on the FTB website into Spanish. Your feedback is important to us. * Social Security Number 9 numbers, no spaces or dashes. Do not include Social Security numbers or any personal or confidential information. Forms, publications, and all applications, such as your MyFTB account, cannot be translated using this Google translation application tool. Forms, publications, and all applications, such as your MyFTB account, cannot be translated using this Google translation application tool. File an original return with a tax liability over $80,000. If you use Web Pay, do not mail the paper payment voucher.

These pages do not include the Google translation application. Impacted by California's recent winter storms? View CEO Survey Results, Marcum Merges Starter-Fluid into National Financial Accounting & Advisory Practice. WebCalifornia Franchise Tax Board. If you have any issues or technical problems, contact that site for assistance. Survey. WebIndividual and Tax Professionals may create and access their account without having to wait for a PIN. File, pay, or check your refund status without registering.

Enter your Social Security Number and Last Name below. Select this payment if you are making an Annual Tax Payment (includes Nonconsenting Nonresident (NCNR) Member Payments). FTB is only responsible for collection of the penalty.  Headquarters 730 3rd Avenue 11th Floor New York, NY 10017, Special Purpose Acquisition Companies (SPAC), Interim Controllership and Financial Leadership, System Organization Controls SOC 1, SOC 2 and SOC 3, Investigations, Forensic Accounting & Integrity Services, The individual taxpayer makes an estimate tax or extension payment that exceeds twenty thousand dollars ($20,000) for any taxable year beginning on or after January 1, 2009; OR. Consult with a translator for official business. We translate some pages on the FTB website into Spanish. Select your Entity Type and enter your Entity ID below. If you use Web Pay, do not mail the paper payment voucher. We use ACI Payments (formerly Official Payments) to process credit card payments. We cannot guarantee the accuracy of this translation and shall not be liable for any inaccurate information or changes in the page layout resulting from the translation application tool. Other payment options available. MyFTB gives individuals, business representatives, and tax professionals online access to tax account information and online services. tax guidance on Middle Class Tax Refund payments, Secretary of State (SOS) certification penalty. We strive to provide a website that is easy to use and understand. These pages do not include the Google translation application. Set location to show nearby results. Do not include Social Security numbers or any personal or confidential information. If the FTB grants a waiver but the taxpayer subsequently meets the mandatory e-pay requirements, the taxpayer must resume making tax payments electronically. Theres a 2.3% service fee if you pay by credit card. We cannot guarantee the accuracy of this translation and shall not be liable for any inaccurate information or changes in the page layout resulting from the translation application tool. You will be asked the source of the pending tax assessment. We are diligently working to resolve the issue to ensure all business entities may use the Web Pay

Our goal is to provide a good web experience for all visitors. Log in to your MyFTB account. . Select this payment type if you received a Notice of Proposed Assessment, Notice of Action, Notice of Revision, or Notice of Determination from FTB. Our goal is to provide a good web experience for all visitors. WebThe web pages currently in English on the FTB website are the official and accurate source for tax information and services we provide. We translate some pages on the FTB website into Spanish.

Headquarters 730 3rd Avenue 11th Floor New York, NY 10017, Special Purpose Acquisition Companies (SPAC), Interim Controllership and Financial Leadership, System Organization Controls SOC 1, SOC 2 and SOC 3, Investigations, Forensic Accounting & Integrity Services, The individual taxpayer makes an estimate tax or extension payment that exceeds twenty thousand dollars ($20,000) for any taxable year beginning on or after January 1, 2009; OR. Consult with a translator for official business. We translate some pages on the FTB website into Spanish. Select your Entity Type and enter your Entity ID below. If you use Web Pay, do not mail the paper payment voucher. We use ACI Payments (formerly Official Payments) to process credit card payments. We cannot guarantee the accuracy of this translation and shall not be liable for any inaccurate information or changes in the page layout resulting from the translation application tool. Other payment options available. MyFTB gives individuals, business representatives, and tax professionals online access to tax account information and online services. tax guidance on Middle Class Tax Refund payments, Secretary of State (SOS) certification penalty. We strive to provide a website that is easy to use and understand. These pages do not include the Google translation application. Set location to show nearby results. Do not include Social Security numbers or any personal or confidential information. If the FTB grants a waiver but the taxpayer subsequently meets the mandatory e-pay requirements, the taxpayer must resume making tax payments electronically. Theres a 2.3% service fee if you pay by credit card. We cannot guarantee the accuracy of this translation and shall not be liable for any inaccurate information or changes in the page layout resulting from the translation application tool. You will be asked the source of the pending tax assessment. We are diligently working to resolve the issue to ensure all business entities may use the Web Pay

Our goal is to provide a good web experience for all visitors. Log in to your MyFTB account. . Select this payment type if you received a Notice of Proposed Assessment, Notice of Action, Notice of Revision, or Notice of Determination from FTB. Our goal is to provide a good web experience for all visitors. WebThe web pages currently in English on the FTB website are the official and accurate source for tax information and services we provide. We translate some pages on the FTB website into Spanish.  For forms and publications, visit the Forms and Publications search tool. The combination must match our records in order to access this service. You should receive your PIN by U.S. mail within 5 to 7 days. WebEstimated tax is generally due and payable in four installments: The first estimate is due on the 15th day of the 4th month of your corporation's tax year. If you have any issues or technical problems, contact that site for assistance.

For forms and publications, visit the Forms and Publications search tool. The combination must match our records in order to access this service. You should receive your PIN by U.S. mail within 5 to 7 days. WebEstimated tax is generally due and payable in four installments: The first estimate is due on the 15th day of the 4th month of your corporation's tax year. If you have any issues or technical problems, contact that site for assistance.