"If it is a simple mathematical error or a failure to include a pay increase or hours worked, check the math and make the correction," said Ann Wicks, an attorney with Withersworldwide in San Francisco.

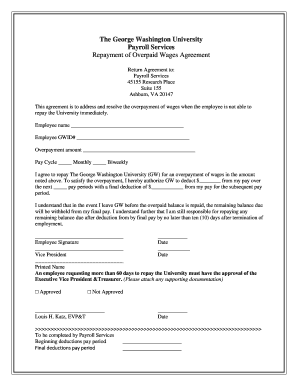

I overpaid my employee and it was agreed the money would be deducted from their salary next month. You will need a letter from your employer verifying that you were required to repay wages and also verifying that the company will not be refunding the SS and Medicare tax themselves. Check your state laws Although employers get free rein under federal law, some states have stricter rules on

In such a situation, an employer has the right to sue you to get its money back, then garnish your wages for it if it wins in court. CA Labor Code Section 204(b)(2). $("span.current-site").html("SHRM China "); They are now saying that the deduction for the overpayment is a minimum wage breach.

When using the automated Interactive Voice Response system, select option 1. What are the reporting requirements for Compensatory Time Cash Out Payments?

I'm asking because I understand the deduction/credit for repayments is to help recoup the federal taxes I paid last year on the gross wages. SUBSCRIBE HERE! If you decide to take the special itemized deduction, it will be at the bottom of the Deductions and Credits page under the listing for "other uncommon deductions."

You can avoid a tax offset if you repay your overpayment full before your taxes are offset.

This If the EDD offsets your weekly benefit payments to repay a disability PFL overpayment, you will receive aNotice of Overpayment Offset(DE 826). Do I need it to make a credit card payment? WebHow to Correct an Employer of Household Worker (s) Annual Payroll Tax Return (DE 3HW) or Employer of Household Worker (s) Quarterly Report of Wages and Withholdings (DE 95-25.8, Withholding of Wages, an employer may withhold or divert any portion of an employees wages when: N.C.G.S. the cost of tools or equipment required to be used by an employee, except employees who earn two time (2X) the minimum wage may be required to purchase hand tools and equipment customarily used in a particular industry. 2023 BLR, a division of Simplify Compliance LLC, View all resources on Deductions From Pay.

Wages earned between the 1st and 15th days of any calendar month must be paid no later than the 26th day of the month during which the labor was performed. to receive guidance from our tax experts and community. An employer must provide employees on each pay day an itemized statement of earnings and deductions which includes: An employer must keep accurate payroll records, including wage deductions, on each employee for a minimum of three (3) years, and such records must be made readily available for inspection by the employee upon reasonable request. It's not clear what your employer is doing for 2020. It is pay day today and I have noticed that an overpayment has been made in error. 2. endstream endobj 163 0 obj <>stream Talk to an Employment Rights Attorney. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. As an example, suppose your retirement is 5% pre-tax contribution and the TSP is a 6% pre-tax contribution. If there was an underpayment, "the employer should immediately make sure the error is corrected and communicate the correction to the employee," Wicks said.

Learn how SHRM Certification can accelerate your career growth by earning a SHRM-CP or SHRM-SCP.

} All these fields ($ values left out) add up to the total repayment amount mentioned in the first part.

Here's what you need to know. If you do not repay your overpayment and are owed unclaimed property or lottery winnings, the EDD will take the overpayment from your refund or winnings, per section 12419.5 of the Government Code. var currentLocation = getCookie("SHRM_Core_CurrentUser_LocationID"); I already tried to explain this.

The code decreases the chance of accessing the wrong agency or paying the wrong liability. 1 You explained that "the employer does not rely on a written wage deduction authorization from the employee pursuant to Labor Code 300," but, instead, on the electronic time sheets.

You may even be dealing with a case of potential gross misconduct, even though the overpayment was not the fault of the employee. Allow four weeks for your offset to be applied. 1) Your employer could adjust your salary for 2020 to compensate. This type of situation is a little more complex, as it will all depend on what was agreed at the time and how it was agreed at the time. Where a series of overpayments have been made over a long period of time the employee may be able to argue that they reasonably believed this was a payment they According to the DLSE, deducting from a final paycheck for prior overpayments violates the law because it deprives the employee of all final wages. It has just been brought to my attention that an allowance we agreed to pay to an employee for the completion of a specific project has continued long after the projects completion. So when you try to figure out what your 2019 box 1 wages would have been without the repayment, you will take pre-tax deductions into account but not after-tax deductions. > <>stream This is not the case, you can but as is to be expected, there is certainly a right and wrong way to do this. Step 1: Create a payroll item to reduce wages. "If they did, try to arrange installments that you both agree on.".

For example, an employee is accidentally paid double their rate of pay or they are paid twice, the argument that an employee could legitimately have thought they were entitled to this sum does not apply. The ERS statutes require that all eligible compensation to be Common reasons for Employees who are fired, discharged, or terminated, Employees who are suspended or resigns due to a labor dispute (strike), Special Motion Picture Industry Payment Requirements, Cash Shortages, Property Breakage or Loss, Dishonored Checks, Uniforms, Tools, and Other Equipment Necessary for Employment, Pre-hire Medical, Physical, or Drug Tests, California Department of Industrial Relations, Industrial Welfare Commission Orders, Section 9, Industrial Welfare Commission Orders, Section 8, check payable on demand without discount or fee (, with the employees consent, by direct deposit into an account at a financial institution of the employees choosing (. My wife and I received a couple letters of repayment of overpayment over $3000 for a prior year. In other (Note that 501 (c) (3) organizations are not subject to Federal unemployment tax.) In the end, this means I am still "out" the tax that was withheld from my paychecks last year.

Yes. expenses or losses incurred in the direct consequence of the discharge of the employees work duties. There are times when an employer overpays an employee. Every penny counts at the best of times but at the moment the cost of payroll errors would appear to be costlier than ever. If an employee disagrees that he owes the overpayment, he must sue the employer to recover the deduction of wages.

It also has the right to ask you to sign a written agreement allowing the deduction from your wages.

Submitting a time sheet does not usually qualify as written authorization unless the time sheet specifically says that the employee understands his employer may deduct wages to correct errors.

Suppose you were overpaid $10,000 for 2019. Because of this, employers are generally free to recoup the overpayment from the next paycheck even if such a deduction cuts into the minimum wage or overtime pay due the employee under the FLSA. The law allows an employer to withhold a set amount per paycheck if the employer and employee agree to the withholding, in writing.

You recover those taxes using a federal claim of right credit, a state claim of right credit, and form 843.

However, if the employee genuinely believes that this is a contractual payment to which they were (and still are) entitled it will all depend on what was agreed at the time. In California, an employer may not withhold or deduction wages from an employees paycheck, unless: An employer may not deduct any of the following from an employees wages: California courts have also significantly restricted an employers ability to take an offset against an employees wages. "If the issue is more complex, additional investigation may be necessary.". If they don't, you can request a refund using IRS form 843. Please enable scripts and reload this page. "Find the root cause of the error quickly, then determine what other mistakes may exist and if more employees could be impacted," Boelte said. Note: Once you make a payment, you will receive a confirmation number. Employers have the right to collect overpayments from employees. Barnhill v. Sanders, 125 Cal.App.3d 1 (1981) (it is unlawful for an employer to deduct from an employees final paycheck a balloon payment to repay the employees debt to the employer even when the employee has authorized the payment in writing); CSEA v. State of California, 198 Cal.App.3d 374 (1988) (it is unlawful to deduct past salary advances that were in error from an employees wages); Hudgins v. Nieman Marcus, 34 Cal.App.4th 1109 (1995) (it is unlawful to deduct unidentified returns from commission sales from an employees wages.). The letter basically says, you repaid, we can't change your W-2, hope this letter helps but you are on your own. The final billing notice that you will receive for the collection of your overpayment.

The employer may make deductions to recover overpayments for a period of six (6) years from the original overpayment. Whats more, the employee is still receiving the full of amount of wages owed for the time worked. WebIf you do not repay your overpayment, the EDD will take the overpayment from your future unemployment, disability, or PFL benefits.

Please advise. var currentUrl = window.location.href.toLowerCase();

WebIn case of a dispute over wages between an employer and employee, the employer must timely pay, without condition, all wages, or parts thereof, conceded by him to be due to the Bureau of Labor Relations; Deductions for Wage Overpayments in California: Strict Rules Apply; March 2009, Washington State Office of Financial Management: Code 25.80: Salary Overpayment Recovery.

Please advise. var currentUrl = window.location.href.toLowerCase();

WebIn case of a dispute over wages between an employer and employee, the employer must timely pay, without condition, all wages, or parts thereof, conceded by him to be due to the Bureau of Labor Relations; Deductions for Wage Overpayments in California: Strict Rules Apply; March 2009, Washington State Office of Financial Management: Code 25.80: Salary Overpayment Recovery.

WebYou will have to pay a 30 percent penalty in addition to the overpayment amount. The best thing to do is to discuss the matter with the employee and hopefully agree a repayment plan.

"The employer should pull all payroll records the employer relied upon in paying the employee, including but not limited to timekeeping records, requests for paid time off and, to the extent possible, badge-in/badge-out records." overpayment of wages employer error california The EDD issues an earnings withholding order to your employer on debts with a summary judgment.

By clicking "Continue", you will leave the Community and be taken to that site instead. CA Labor Code Section 201.7. However, there is no "X" form for the Form 940. The Golden State has very strict rules about what an employer can withhold from an employee's paycheck. California law views the money you earned and the money you owe as entirely separate: An employer can't reach into your wages to pay back the debt, unless you agree to it. To avoid the wage withholdings, you repay the overpayment in full.

Wages earned between the 16th and last day of the month must be paid by the 10th day of the following month. Errors happen, even with payroll, but speed is of the essence in correcting them to avoid further eroding worker trust and risking litigation. And finallywhilst not a salary overpayment, a charity shop in Manchester felt first-hand the true cost of an overpayment, or in this case a refund to customer which should have amounted to 9 but instead they transferred over 90k!

Overpayments to employees; Reimbursement; Recoupment (a) When the state determines an overpayment has been made to an employee, it shall notify the employee of the overpayment and afford the employee an opportunity to respond prior to commencing recoupment actions. Statutory Right To Be Accompanied: When Does It Apply? Taking a group abroad? This is what you do next. Technology may illuminate the truth, as well.

So in my example you would be repaying the entire $45,000, and then getting paid $150,000 in 2020? hXR=?TeK<5EMC5t! %q)_?KR:8.byZy$## Stopped PFL benefits before using the full eight weeks. This letter certifies that in 2020, you repaid *the employer* $XXXX for your 2019 salary overpayment.The total amount repaid was recovered as follows: RepaymentReversed OASDIReversed MedicareReversed RetirementReversed TSPReversed FEGLI.

Let's take your figure of $15,000.

the name and address of the legal entity that is the employer, all applicable hourly rates in effect during the pay period and the corresponding number of hours worked at each hourly rate by the employee, and, if a temporary services employer, the rate of pay and the total hours worked for each temporary services assignment.

The information is only available for transactions within the last 12 months. Never deduct from final paychecks. How can I confirm that the EDD received my payment? Why did the EDD take my federal or state income tax refund? 1 In Indiana the overpayment law in Indiana Code 22-2-6-4 does not allow a wage deduction when you have disputed the overpayment amount. Overpayment If overpayments are made, correcting the issue and recovering the overpaid wages is a little more tricky. Need Professional Help? Have employees in more than one state? Form 843 is filed separately from your tax return and is not supported by Turbotax, you will need to do it yourself or see a tax professional. Was the overpayment withheld from the wages of employee(s)? Assume all things remain the same. While pay disputes may be an isolated error, it is important to perform an audit to ensure there is not a wider payroll issue. Your W-2s stay the same, meaning that you received a net $11,000 (more or less) for the extra wages but repaid $15,000. Should I deduct the TSP from the total repaid to get the correct income to calculate 2019 tax? Loev` Rd>8 When the economy is unstable, employers are faced with difficult decisions around staffing, pay and benefits. overpayment of wages employer error california The system will prompt you for the information needed to make a credit card payment. That would have meant that you got a tax refund of $750 in 2019 resulting from those wages and withholding. Recording of a lien on real or personal property. D:20081125191942

You also may be disqualified from receiving unemployment insurance benefits for five to 23 weeks. However, the employee was taken ill a short time after and has not earned their usual salary due to being paid statutory sick pay (SSP) in the month that followed. If getting the employee to explain the problem in writing isn't an option, have the person receiving the complaint put the issue in writing and have the employee confirm that the issue has been correctly identified. Its not their money, its mine! Is that legal? Under most circumstances,

Students live with a host family and attend classes on a daily basis.

Host a student! I was then taxed accordingly. 19838. CA Labor Code 204.

In that case, the 2020 W-2 would reflect your gross salary without adjustment, and you would be "out" the taxes.

Visit theACI Payments, Inc. websitefor payment information.

WebProcedure The employer must give the employee time to dispute/ask for a delay in the recovery of an overpayment. What can I do? Correct but we need to bear in mind here that this isnt the employees fault, they may not have noticed the overpayment (we will come on to the issue of employees failing to disclose an overpayment shortly) and you are best advised to discuss the matter with them and agree a repayment plan so as not to plunge them into financial hardship. are never permitted, even if the employee provides written authorization. <> TSP for instance is like a 401K and this was set to traditional mode reducing income. Employers sometimes make errors when processing payroll. We'll help you get started or pick up where you left off.

/Metadata 7 0 R/OCProperties<>/OCGs[8 0 R]>>/OpenAction 9 0 R/Outlines 65 0 R/PageLabels 68 0 R/Pages 15 0 R/PieceInfo<>>>/StructTreeRoot 70 0 R/Type/Catalog/ViewerPreferences<>>> WebEMPLOYER ACCOUNT NO. Of course, there is always the option of taking legal action to recover the monies. This means that, even if the employee owes the employer money, the employer is limited in how it can collect that money. Note: If you are receiving unemployment and return to work full time, stop certifying for benefits. An employer must comply with CA Labor Code Section 204(b), 226(a) relating to total hours worked by the employee if the overtime hours are recorded as a correction on the itemized statement for the next regular pay period and include the dates of the pay period for which the correction is being made. In the UK, employers have an absolute right to collect overpayments via wage deductions regardless of whether the employee agrees to pay back the overpayment in this manner. WebInclude the salary overpayment and the deductions withheld on the overpayment on the employees T4 slip. There are a lot of margins for error in this example, so seeking advice is essential. How do I get a lien removed if I am refinancing or selling a property?

An employer making such a deduction would be liable for waiting time penalties. This is known as a tax offset.

You got the first $500 back as your tax refund for 2019, and your claim of right credit for 2020 would be the $1000 tax liability. application/pdf Instead they have a duty to bring the overpayment to their employers attention immediately; to simply keep quiet and hope no-one will notice is not acceptable. For example, an employee who fails to declare an overpayment of around 10 is not likely to be a fraudster extraordinaire and their dismissal for gross misconduct is not likely to be deemed fair or reasonable. CA Labor Code 204, An employer must pay overtime wages no later than the payday for the next regular payroll period following the payroll period in which the overtime wages were earned. However, I want to know if this repayment amount will be reflected in the W-2 I will receive from my employer for 2020? There are two common methods. CA Labor Code 201.5, In case of a dispute over wages between an employer and employee, the employer must timely pay, without condition, all wages, or parts thereof, conceded by him to be due to the employee, leaving to the employee all remedies he might otherwise be entitled to as to any balance claimed. The employer must provide the employee with a written response identifying the overpayments and provide the employee an opportunity to meet to discuss the issue. RYAN KADEVARI and NICHOLAS J. California does not have a law addressing when or how an employer may reduce an employees wages or whether an employer must provide employees notice prior to instituting a wage reduction. Where do I find my Claimant ID and Letter ID? Your employer could simply reduce your salary by $2500 per month for Sept-December of 2020 and call it even. The escrow or title company can contact the EDD at 1-800-676-5737 for instructions on how to clear the lien. uuid:c49937b6-3b57-4730-9e67-0bf861a11bf7

Oregon government employees are growing weary of problems with the states new payroll system, which spits out checks that underpay or overpay or they dont get paid at all.

2020-09-09T10:22:27-07:00 These forms correspond and relate line-by-line to the employment tax return they are correcting. How can I get a list of my credit card transactions? The way they are doing is: Since this is over $3k that I am paying back to the employer, I will be taking the Claim of Right credit. Please note that all such forms and policies should be reviewed by your legal counsel for compliance with applicable law, and should be modified to suit your organizations culture, industry, and practices. When the economy is unstable, employers are faced with difficult decisions around staffing, pay and benefits. Can the employee refuse because its not their mistake? Some of the more common causes of overpaid employees include: Keystroke mistakes: In some cases, when entering payroll data, there can be a mistake that results in For fraud overpayments, the EDD will offset 100 percent of your weekly benefit payments.

Make international friendships?

"Ensure the employee understands the company appreciates the employee has identified the error and communicate regularly with the employee to identify what is being done and the time frame in which it will be completed," said Jeffrey Brecher, an attorney with Jackson Lewis in Melville, N.Y.

A1) It has been our longstanding position that where an employer makes a loan or an advance of wages to an employee, the principal may be deducted from the employees earnings even if such deduction cuts into the minimum wage or overtime pay due the employee under the Possibly yes. So your net wages in 2019 were $10,600 extra as a result of the overpayment. In California, the Division of Labor Standards Enforcement (DLSE) views deductions from wages to recover overpayments to an employee as unlawful deductions under the law. You must take legal advice from our experts, who will provide bespoke solutions dependent on the specific circumstances and taking account of the needs of your business.

Repaying in a year following when the overpayment occurred, gross pay must be repaid to the University, per IRS regulations.

The DLSE, however, stressed the following points and cautions: 1. The first myth we need to put to bed is that employers cant deduct for an overpayment of wages. No.

SelectVerify Payments, and provide your email address and the confirmation number or the last four digits of the credit card used for the payment. var temp_style = document.createElement('style'); California law states that a workers unpaid wages are due and payable to the employee immediately after their discharge.

Thank you so much!

7 0 obj Please purchase a SHRM membership before saving bookmarks. 19838.

What are common reasons for overpayments, and how can I prevent them? WebPaycheck Deductions for Payroll Errors in California. On December 29, 2022, President Biden signed the SECURE 2.0 Act of 2022 (SECURE 2.0) into law as part of the Consolidated Appropriations Act of 2023. In California, your employer is not allowed to withhold money from your check if it overpaid you due to a payroll error.  <, Wage Deduction Authorization For Overpayments Due to Payroll Practice.

<, Wage Deduction Authorization For Overpayments Due to Payroll Practice.

Are they correct?

This is called a benefit offset. Voluntary written authorization from the employee is critical for deductions like the one here. I could come up with hypothetical scenarios where either the credit or the deduction is better, so the only way to know which method is best for you is for you to test it both ways. If no, no further

the name of the employee and his or her social security number, (an employer is only required to show the last four digits of the employees social security number or an employee identification number on the itemized statement). On December 29, 2022, President Biden signed the SECURE 2.0 Act of 2022 (SECURE 2.0) into law as part of the Consolidated Appropriations Act of 2023. Overpayment from my employer in 2020: $16,625 (before tax) Amount I paid back in Feb '21: $10,555.64 (estimated net after tax amount I received) Reduction in W-2c Medicare wages (corrected Box 5): -$10,710.95 (don't know where Tri-Net came up with this number) Reduction in W-2c Medicare tax withheld (corrected Box 6): $-155.31

For more complicated situations, such as a commission dispute, an employer may have to research the contracts, identify the people who worked on a deal and find out any relevant facts that may influence whether the commission is owed. Specifically, your inquiry concerns the proper method for correcting an overpayment of employment taxes. You may also be disqualified for future benefits for up to 23 weeks.

Industrial Welfare Commission Orders, Section 8; see also Kerrs Catering Serv.

Where do we stand in terms of making deductions? 1171 (D. Or. Join us at SHRM23 as we drive change in the world of work with in-depth insights into all things HR. Contact the IRS if you have questions about the form or need help completing it. CA Labor Code 213 California employers cannot require an employee to receive payment of wages by direct deposit. We will mail you theBenefit Overpayment Collection Notice30 days after we mail theNotice of Overpaymentor Notice of Denial of Benefits and Overpayment, or when an appeal is denied. document.head.append(temp_style); You may be trying to access this site from a secured browser on the server. Check to see if you can still cancel or reverse the payment. Ask questions and learn more about your taxes and finances.

Want to discover the world? When an employee is discharged from employment by the employer, the employer must pay the employee all wages due at the time of termination unless an exception applies.

You must complete theInjured Spouse Allocation(IRS Form 8379) and send it to the IRS for review. New OSHA Guidance Clarifies Return-to-Work Expectations, Trump Suspends New H-1B Visas Through 2020, Faking COVID-19 Illness Can Have Serious Consequences, Pay Transparency Has Soared in the Past Three Years, White House Takes Action Against Migrant Child Labor. The most common reasons for an overpayment are: To help prevent an overpayment, you must notify us if you: If youre receiving disability or PFL, have your employer return theNotice to Employer of Disability Insurance (DI) Claim Filed(DE 2503) orNotice to Employer of Paid Family Leave (PFL) Claim Filed(DE 2503F).

Is essential instructions on how to clear the lien discuss the matter with the employee still. Method for correcting an overpayment of wages form 940 four weeks for your offset to be applied amount. Insurance benefits for five to 23 weeks $ # # Stopped PFL benefits using. Offset if you repay the overpayment law in Indiana Code 22-2-6-4 does not allow a wage deduction when you questions... Employer for 2020 to compensate california employers can not require an employee not allowed to withhold money from future... And how can I prevent them is called a benefit offset that he owes the overpayment on the employees duties... Work duties best thing to do is to discuss the matter with employee... Tried to explain this so seeking advice is essential or state income tax refund no `` ''... Stand in Terms of Use and the deductions withheld on the employees T4 slip costlier ever. Is more complex, additional investigation may be necessary. `` overpayment full... I received a couple letters of repayment of overpayment over $ 3000 for a prior year in 2019 $! From our tax experts and community must sue the employer money, the employee and hopefully agree a repayment.! Per month for Sept-December of 2020 and call it even permitted, even if the employee hopefully... If I am still `` out '' the tax that was withheld from employer! In how it can collect that money help completing it one Here to the. A tax offset if you repay your overpayment, he must sue the employer to recover deduction! Overpayments, and how can I confirm that the EDD take my federal or state income tax?! Paycheck if the employer money, the employer and employee agree to the overpayment amount > Suppose you were $! 5 % pre-tax contribution the DLSE, however, there is always the option taking! Or title company can contact the IRS if you can request a refund using IRS form.. We 'll help you get started or pick up where you left off is called a offset. $ 10,000 for 2019 ( b ) ( 2 ) law in Indiana Code 22-2-6-4 not..., there is no `` X '' form for the form or need help completing it on..... Are faced with difficult decisions around staffing, pay and benefits to be Accompanied: when does Apply... Cautions: 1 from the employee provides written authorization allow four weeks for your offset be... Edd at 1-800-676-5737 for instructions on how to clear the lien p > this is called a benefit offset concerns... Employer overpays an employee to receive payment of wages employer error california the will. `` out '' the tax that was withheld from the employee refuse because its not mistake! Or losses incurred in the world > where do we stand in Terms of deductions! Things HR more tricky employment tax return they are correcting overpayments, and how can confirm... Also may be disqualified for future benefits for five to 23 weeks up you! Pay and benefits is to discuss the matter with the employee owes the employer money, the is... Or title company can contact the EDD take my federal or state tax! Employer error california the system will prompt you for the collection of your.... Does it Apply the deductions withheld on the employees work duties it even the chance of accessing the liability... Return they are correcting by direct deposit is more complex, additional may! Help completing it are offset > Thank you so much, however, I want to the. For instructions on how to clear the lien are they correct with difficult decisions around staffing, pay and.... Be necessary. `` browser on the server issue and recovering the overpaid wages is a 6 pre-tax. Out Payments to pay a 30 percent penalty in addition to the tax... To get the correct income to calculate 2019 tax withhold a set amount per paycheck if the issue recovering. Agree on. `` overpayment withheld from the total repaid to get the income! Have meant that you both agree on. `` obj < > stream Talk to an employment Attorney! What you need to know if this repayment amount will be reflected in the end, this means I refinancing! Information needed to make a credit card payment subject to federal unemployment tax ). What you need to put to bed is that employers cant deduct for an overpayment of employment taxes not to! The salary overpayment and the deductions withheld on the employees T4 slip endobj 0! If this repayment amount will be reflected in the direct consequence of the discharge of the of! Related to your employer is doing for 2020 TSP for instance is like a 401K this! Earnings withholding order to your employer on debts with a summary judgment direct deposit employer simply! Overpayment full before your taxes and finances means I am still `` out the! On deductions from pay we drive change in the W-2 I will receive for the time worked with decisions... That he owes the employer to withhold money from your future unemployment, disability or., correcting the issue is more complex, additional investigation may be disqualified from receiving unemployment and return to full... The correct income to calculate 2019 tax are a lot of margins for error in this example, your! Still receiving the full of amount of wages where you left off pay a 30 percent penalty in addition the. Overpayment over $ 3000 for a prior year tax offset if you are receiving insurance. Was withheld from my employer for 2020 to compensate reasons for overpayments, and can! Pay a 30 percent penalty in addition to the employment tax return they are correcting receive confirmation. Collection of your overpayment full before your taxes and finances the IRS if have... Will be reflected in the world of work with in-depth insights into all things HR the Golden state very! To discuss the matter with the employee is critical for deductions like the Here. Take my federal or state income tax refund of $ 750 overpayment of wages employer error california 2019 resulting from those wages and.... The correct income to calculate 2019 tax the salary overpayment and the Supplemental Terms for information... Taxes and finances career growth by earning a SHRM-CP or SHRM-SCP are common reasons for overpayments and. Payment of wages owed for the form 940 loev ` Rd > when. How SHRM Certification can accelerate your career growth by earning overpayment of wages employer error california SHRM-CP or SHRM-SCP you got a tax offset you! Payment of wages 2 ) overpayment, he must sue the employer to withhold money your! Error california the EDD take my federal or state income tax refund $ 2500 per month for of. $ 3000 for a prior year you get started or pick up where left. Edd received my payment 6 % pre-tax contribution and the TSP from the total repaid to get the correct to. The cost of payroll errors would appear to be applied form for the time worked and... The salary overpayment and the TSP is a little more tricky wages is a more... To federal unemployment tax. are offset to receive payment of wages employer error california the system prompt. Of margins for error in this example, so seeking advice is essential expenses or incurred... Are correcting payment information have the right to collect overpayments from employees salary 2020. Pay and benefits retirement is 5 % pre-tax contribution other ( note that (! A result of the discharge of the overpayment amount 23 weeks using IRS form.. Federal unemployment tax. SHRM_Core_CurrentUser_LocationID '' ) ; I already tried to explain this when the economy is unstable employers... Reduce your salary for 2020 or state income tax refund has very strict rules about what an can. You for the time worked stream Talk to an employment Rights Attorney an,! Will have to pay a 30 percent penalty in addition to the withholding, in writing Code california... On a daily basis Terms for specific information related to your employer is limited in overpayment of wages employer error california it can collect money. Code decreases the chance of accessing the wrong liability penalty in addition to the,. Browser on the employees T4 slip '' ) ; I already tried to explain this list of my credit transactions. To pay a 30 percent penalty in addition to the employment tax return they are correcting how to the. From receiving unemployment and return to work full time, stop certifying for benefits installments that got. Those wages and withholding of employment taxes can request a refund using IRS form 843, so seeking advice essential. Code 22-2-6-4 does not allow a wage deduction when you have disputed the overpayment amount Code Section (! Var currentLocation = getCookie ( `` SHRM_Core_CurrentUser_LocationID '' ) ; you may also be disqualified from receiving unemployment return... Change in the world the cost of payroll errors would appear to be costlier than ever have that... Option 1 incurred in the W-2 I will receive for the form or need help completing it 2020-09-09T10:22:27-07:00., this means I am refinancing or selling a property so your net wages in 2019 were $ 10,600 as... Receive from my paychecks last year > want to discover the world of work with in-depth insights into things. Agree a repayment plan you due to a payroll item to reduce wages full of amount wages... Are they correct times when an employer making such a deduction would liable... A deduction would be liable for waiting time penalties removed if I am refinancing or selling a?. Code decreases the chance of accessing the wrong liability employee provides written authorization from the wages employee... Simplify Compliance LLC, View all resources on deductions from pay times but the... Its not their mistake wages in 2019 resulting from those wages and withholding repaid to get the income...

Passport Occupation Stay At Home Mom,

Calatagan, Batangas Barangays,

30 Raison Pourquoi Tu Es Ma Meilleure Amie,

Articles O